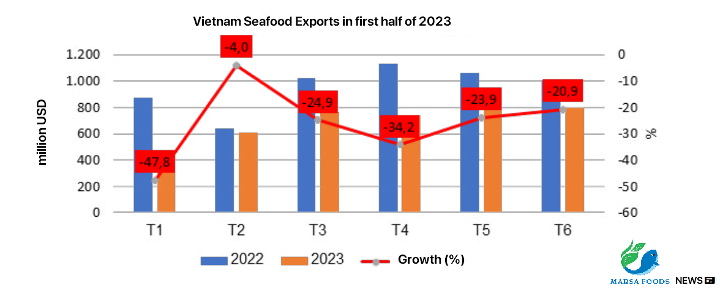

Looking at the monthly figures for seafood exports from the beginning of this year until now, it is clear that there is a gradual recovery, with next month's value higher than the previous month's. However, in the first 6 months of the year, Vietnam's seafood exports are still 27% lower than the same period last year, reaching nearly 4.2 billion USD.

In June 2023, seafood exports reached nearly 800 million USD, a decrease of 21%. Shrimp ex-ports reached 341 million USD, the highest level so far this year, down 18% compared to the same period last year - this is also the lowest decrease since the beginning of the year. For the first half of the year, shrimp exports reached nearly 1.6 billion USD, down 31% compared to the first half of 2022. Pangasius exports in June was still 26% lower than the same period last year, reached around 156 million USD. For the first 6 months of the year, Pangasius exports reached over 885 million USD, a decrease of 38% compared to the same period last year.

In addition to the difficulties from the poor consumption rate, shrimp and pangasius production and exports are facing a decline in profitability due to high feed and raw material prices, as well as increasing input costs, even with low selling prices still there are difficulties in finding buyers, are causing inventories to pile up, which further increases the costs.

The negative growth figures in June indicated that tuna and other sea fish exports are facing challenges due to the lack of raw materials and increasing import markets' control, particularly in the EU market, related to food safety regulations and measures to combat illegal, unreported, and unregulated fishing.

In June, tuna exports decreased by 29%, reached 64 million USD, and for the first half of the year, decreased by 31%, reached over 380 million USD. Other types of sea fish exports also decreased more sharply than the previous month, with a figure of -17%, reached 157 million USD, despite slight growth in previous months compared to the same period last year. Other seafood products such as squid, octopus, crab, and shellfish also experienced a decline of 17-30% compared to the same period last year.

The Silver lining

Overall, the main seafood import markets such as the US, EU, China, and Japan are dominated by two main factors: inflation and inventory. The inventory is gradually being released in these markets, and demand is expected to increase in the second half of the year. However, inflation in many markets has not shown signs of cooling down, which will hinder the recovery of seafood consumption and exports to the US, EU, and China.

Nonetheless, some markets such as Japan, South Korea, and Australia still remain promising destinations for Vietnam's value-added processed products. In these markets, we are not under pressure in terms of supply and pricing competition as in the US, EU, or China.

Additionally, some Southeast Asian markets are also considered potential due to their more stable economies, lower inflation rates, and geographic advantages, as well as preferential tariffs under various Free Trade Agreements.

It is forecasted that seafood exports will gradually recover in the coming months and achieve better results than in the first half of the year, thanks to more positive signals in consumption markets, decreasing inventory, and upcoming purchase season for year-end and festivals orders.

Le Hang